12 Things They Don't Tell You About Duty-Free Shopping

Browsing through the goods in the duty-free shops is a small pleasure for many travelers. Picking up a little something from the shelves of local products and luxury treats can be a fun kick-off to your cross-border trip or a pleasurable way to cap off your holiday before returning home.

Duty-free shops are located wherever people are leaving the country: at land border crossings, cruise ship terminals, and at international airports, usually after security. They generally carry alcohol, tobacco, make-up and perfume, jewelry, and products made in the country you are about to leave — things like maple syrup in Canada, coffee in Costa Rica, or chocolate in Switzerland.

When making your purchase at an airport, the cashier will ask for your boarding pass and passport to purchase duty-free merchandise. This ensures the sale complies with the requirement that duty-free goods be used or consumed out of the country. Depending on what you buy and in which country you buy it, you can either take the purchase with you in a sealed bag, or the item will be brought to you at the gate during boarding. Before you break out your credit card to stock up though, there are a few things to know about duty-free shopping.

What is duty-free?

For all intents and purposes, "duty" basically means "tax." This includes import fees, sales tax or value-added tax, and vice taxes that are charged on tobacco and alcohol. So "duty-free" means those fees aren't part of the price you pay. Anything that is sold duty-free is sold with the understanding that it will be used after you leave the country, which creates a kind of retail "no man's land," as far as taxation goes. This can result in savings for shoppers.

According to Investopedia, "Duty-free regulations vary depending on your country of residence, travel destination, and length of stay. Other rules apply to the items purchased, the cost of the article, and the country of its manufacture." However, your purchases must fall within the limits you are allowed to bring into the country you are traveling to. If not, you'll need to pay import duties once you arrive.

Duty-free isn't always cheaper

Don't assume the duty-free store is automatically less expensive. Even though taxes are less on duty-free goods, the price at a duty-free shop doesn't necessarily equate to significant savings. Duty-free stores still have all the same overhead expenses as any other business, like rent, wholesale costs, and wages, so markups remain. Plus, if you are shopping before you fly, you have airport pricing to contend with.

You may have noticed prices on everything are generally more expensive at the airport (the dreaded "airport premium.") As Vox points out, "Concessionaires deal with costs and obstacles normal businesses outside of airports don't have to, such as getting employees security clearances and badges and getting inventory delivered and stored." Higher airport prices are also partly due to the rental fees retailers are charged to set up shop.

In addition to considering the airport premium pricing, remember that duty-free savings are due to the fact you aren't paying tax. So items that have a lower tax rate, (electronics, for example) will offer less savings in a duty-free shop. A quick search on your phone can help you determine if something is actually a deal.

Savings will depend on what you buy

Since the great prices you can find at duty-free stores are based on avoiding local taxes, it goes to reason that things that are taxed at higher rates will offer the biggest savings. Avoiding the "sin" or "vice" taxes levied on alcohol and tobacco locally means that buying them duty-free is generally a good deal. Sometimes duty-free shops will run sales and special offers, for instance, that offer a reduced price for two bottles of spirits or a free carton of cigarettes when you buy two. Remember, however, there are limits to how much you can bring into a country. When returning to the U.S., residents are limited by both the price of their purchases and the amount of alcohol and tobacco products they are bringing home.

Make-up, skincare, and fragrances are also generally a good purchase. Stock up on products that aren't sold in your home country, particularly if you are in the country where the products originate. Fans of Japanese and Korean skincare and cosmetics know duty-free stores are your last chance to stock up on the specialty products you won't find at home. Candy and treats are another good bet in the duty-free shops. Look for different or exotic flavors of familiar candies, novelty sizes, or treats that aren't sold at home. A perennial favorite to bring to the U.S. are Cadbury chocolates, which have a different fat content in the U.K. than they do across the Atlantic.

Be aware of connecting flights

If you aren't flying directly to your destination, you'll have to pass through security at the connecting airport. Unfortunately, your newly purchased duty-free bottle of Scotch and tube of luxury skin cream are likely over the 3.4 oz (100 ml) liquid carry-on allowance. Remember, this limit applies to anything that spreads, sprays, or pours. Since duty-free shops are after security, you will have already checked your suitcase at your departure point, meaning you don't have the option to put purchases into your checked luggage. However, if you're picking up your checked baggage to recheck it at a connecting airport, then you'll have the chance to pop your purchases into your suitcase later.

Often, your luggage will be checked straight through to your destination. If that's the case, you will need to ensure that any liquids, aerosols, or gels you buy at the airport duty-free are packaged in a transparent, tamper-proof bag at the store. They usually do this automatically at the point of sale, but if they don't, make sure you tell the cashier you have a connecting flight and need to have your purchase in a sealed bag.

When you are going through security, you will need to have your receipt ready to show the officers. If your destination is in the U.S., your purchase must be within 48 hours of your arrival. Bear in mind, that even if you follow all the rules, the security officer ultimately has the discretion to allow your luggage through or not with your duty-free purchases.

How much you can bring back depends on where you go

For U.S. residents, the limit you can bring back into the country depends on where you made your purchases. Those returning from almost anywhere in the world have a limit of $800 worth of goods they may bring back without paying a customs fee. (Alcohol and tobacco purchases have additional limits.) That's as long as you have been out of the country for at least 48 hours. If you have been gone less than 48 hours, the limit is $200.

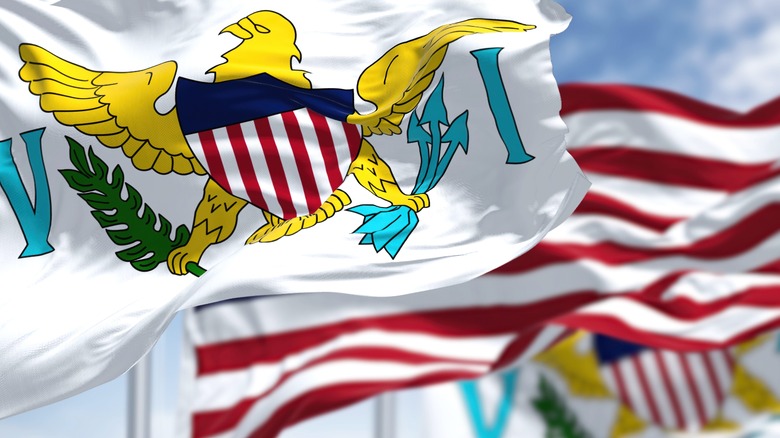

There's an important exception to this rule that will interest those who want to splurge at the duty-free shops (or other places, as these rules aren't specific to duty-free shops). If you have been out of the U.S. for longer than 48 hours and made your purchases in what is referred to as a "U.S. Insular Protection" country, then that limit doubles to $1600.

"What is a U.S Insular Protection country?" you may ask. According to the Federal Register, "Insular possessions of the United States are defined as American territories outside the customs territory of the United States." To simplify, they are the U.S. Virgin Islands, Guam, American Samoa, Wake Island, Midway Island, and Johnston Atoll. Lastly, you are eligible for an increased alcohol limit as long as one of the bottles is a product from the place you're bringing it from.

Different countries have different rules

The limits that apply to U.S. residents returning to the U.S. are different from limits in other places in the world. For instance, in some countries, your personal import limit is based on how long you have been away. In the U.S., as long as you have been away for at least 48 hours, your personal exemption doesn't vary (in most cases). However, in Canada, the limit for residents increases based on whether they have been away for between 24 and 48 hours, 48 hours to one week, and over seven days.

When traveling to Europe, you may find the allowances fairly generous. If you are coming from a non-European Union country, you can bring the following, according to the European Union: "4 litres of wine and 16 litres of beer plus 1 litre of spirits over 22 % vol. (such as vodka or gin) or 1 litre of undenatured alcohol (ethyl alcohol) of 80% vol. (or over) or 2 litres of fortified (for example sherry or port) or sparkling wine". This is only for personal use, mind you.

Buy as much duty-free as you like, but ...

If you go over your duty-free purchase limit, you must declare it and pay the tax. Just because you are generally limited to $800 worth of goods or 1 liter of alcohol, 200 cigarettes, and 100 (non-Cuban) cigars on your return to the U.S. doesn't mean you can't bring more home. As long as your purchases are for personal use and meet the state law, you can — but you will have to pay. If you go over the import limit, declare it on your customs card. Don't try to sneak it in, as you may face having your things confiscated or stiffer penalties. Simply pay the assessed fees in U.S. dollars or with a personal or government check (some points of entry now also accept credit cards).

According to Customs and Border Protection, the fees are usually 3%, although some exceptions apply. For example, goods made and bought in Mexico and Canada have exemptions under the North American Free Trade Agreement. On the other hand, goods from Austria, Belgium, Denmark, Finland, France, The Federal Republic of Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden, and Ukraine may incur a 100% duty fee. That means you will pay in duty as much as you paid for the things you bought. So you may want to reel in your spending in those countries!

You can shop duty-free on arrival in some countries

We often think of stocking up on duty-free goodies on the way out of a country, but in many countries, you can do your shopping on the way in. These countries include some biggies like Australia, Brazil, India, Indonesia, the Russian Federation, Thailand, Turkey, and the United Arab Emirates. It's a great option for travelers for a few reasons, chief among them because you don't have to pack your purchases in your carry-on luggage.

Since paying for checked baggage is the standard for many airlines, carry-on space is often at a premium for people trying to avoid the extra cost. The less stuff you need to stow the better! Travelers are also becoming more conscious of the environmental impact of additional weight on planes. This has resulted in passengers striving to keep their baggage light, and buying duty-free stuff on arrival means avoiding that extra weight.

Duty-free does not mean responsibility-free

Duty-free alcohol is subject to the same rules as all other liquor. As tempting as it may be to crack into your bottle for a nip, try to restrain yourself. Drinking your own alcohol on an airplane is against the law. The Federal Aviation Administration (FAA) is clear: "FAA regulations prohibit passengers from drinking alcohol on board the aircraft unless it is served by the air carrier." This isn't because the airlines are trying to maximize profit; it also has to do with safety. The flight crew needs to have an idea of how much passengers are drinking. In an emergency, someone too drunk to help themselves is a danger.

Alcohol sold at duty-free shops at cruise ship ports will be held for you until final disembarkation on most ships, although some cruise lines allow a certain amount of wine and beer in your stateroom. They may charge a corkage fee, though. Finally, if you buy liquor at a land border crossing, we know we don't have to tell you, but drinking and driving isn't wise.

You can maximize limits in groups

You can't do anything about the limits, but you can work with how they are applied. The limits you are permitted to bring into the country apply per person, so it may make the most sense to share the purchases among your traveling party.

For example, if one person has spent $1000 in Costa Rica and their companion only bought $200 worth of souvenirs, it's allowable to declare $600 each so that each person stays under the $800 limit. Similarly, if one person bought two bottles of vodka, each adult can declare one bottle to avoid going over the limit and incurring duty fees when you return to the U.S.

Regardless of who in your party is declaring the items, all the laws still apply. The goods must be purchased as gifts or for personal use, and you are only allowed to use your exemption once within 30 days. Of course, age laws still apply too, so, no, your preschooler cannot bring cigarettes into the country, even if they go to a really rough school.

You can shop duty-free online or while you fly

When you think of buying duty-free, you might picture a boutique on a cruise ship, brightly lit stores in the airport, or busy outlets beside the highway. You might not think of your seat on an airline or your couch at home. With the absence of inflight magazines and catalogs in the seatback pocket, the range of things available to buy while you fly may not be front of mind. However, most international flights still sell some duty-free items. If they don't have it in print, chances are the items will be listed on inflight entertainment channels or the airline's website. They may have the items on board for you to take right away, or the items will be shipped to your home.

Another option is to shop ahead from home to pick up your duty-free items at the airport when you arrive. You can find the duty-free stores listed on your airport's website. Place the order online from the store's website, usually a minimum of two hours before your flight is scheduled to board, and have it ready and waiting for you.

You can save by comparing prices among different airports

At the end of a trip, you may find yourself with a pocketful of foreign change. You can exchange paper currency at home or save the coins for your next trip, but may we suggest treating yourself to a duty-free treat? Duty-free shops are used to splitting purchases between different forms of payment. Just let the cashier know that's what you'd like to do. It's easy enough to pay for a portion of your little chocolate or local delicacy with the leftover currency and put the balance on your credit card.

Before you use up your change, though, you may want to do a bit of comparison shopping to net yourself the best deal. Many duty-free stores list their stock and prices online, making a quick search really easy. For example, a small bottle of champagne at Duty Free Americas in JFK is currently listed at $74. That same bottle at the Heinemann Shop in Berlin Brandenberg is €52.90, which, at the time of writing, is $57.35. If you are flying between the two, buying the bottle at the Berlin airport instead of JFK offers fairly significant savings.